Tuesday, March 31, 2009

Monday, March 30, 2009

Rolling Stone's Matt Taibbi pwns Aig exec

"I take this action after 11 years of dedicated, honorable service to AIG. I can no longer effectively perform my duties in this dysfunctional environment, nor am I being paid to do so. Like you, I was asked to work for an annual salary of $1, and I agreed out of a sense of duty to the company and to the public officials who have come to its aid. Having now been let down by both, I can no longer justify spending 10, 12, 14 hours a day away from my family for the benefit of those who have let me down." via Op-Ed Contributor -- "Dear AIG, I Quit!" -- NYTimes.com

Like a lot of people, I read Wednesday's New York Times editorial by former AIG Financial Products employee Jake DeSantis, whose resignation letter basically asks us all to reconsider our anger toward the poor overworked employees of his unit.

DeSantis has a few major points. They include: 1) I had nothing to do with my boss Joe Cassano's toxic credit default swaps portfolio, and only a handful of people in our unit did; 2) I didn't even know anything about them; 3) I could have left AIG for a better job several times last year; 4) but I didn't, staying out of a sense of duty to my poor, beleaguered firm, only to find out in the end that; 5) I would be betrayed by AIG senior management, who promised we would be rewarded for staying, but then went back on their word when they folded in highly cowardly fashion in the face of an angry and stupid populist mob.

I have a few responses to those points. They are 1) Bullshit; 2) bullshit; 3) bullshit, plus of course; 4) bullshit. Lastly, there is 5) Boo-Fucking-Hoo. You dog.

The rest here

Like a lot of people, I read Wednesday's New York Times editorial by former AIG Financial Products employee Jake DeSantis, whose resignation letter basically asks us all to reconsider our anger toward the poor overworked employees of his unit.

DeSantis has a few major points. They include: 1) I had nothing to do with my boss Joe Cassano's toxic credit default swaps portfolio, and only a handful of people in our unit did; 2) I didn't even know anything about them; 3) I could have left AIG for a better job several times last year; 4) but I didn't, staying out of a sense of duty to my poor, beleaguered firm, only to find out in the end that; 5) I would be betrayed by AIG senior management, who promised we would be rewarded for staying, but then went back on their word when they folded in highly cowardly fashion in the face of an angry and stupid populist mob.

I have a few responses to those points. They are 1) Bullshit; 2) bullshit; 3) bullshit, plus of course; 4) bullshit. Lastly, there is 5) Boo-Fucking-Hoo. You dog.

The rest here

Friday, March 27, 2009

UGK WEEK #1

The final UGK album comes out next Tuesday. All signs point to it being classic, and that's about as bittersweet as it gets. Here's the original version of Front, Back, & Side to Side of their album Super Tight.... One thing you should know about Super Tight... is Leo Nocentelli, aka the guitarist from the Meters, played on damn near the whole album. And as the saying goes, "how many rappers rap over a meters beat, but how many of them record with them in the actual studio?"

Front, Back, & Side to Side

We only have a few days to dive in the UGK discography as a whole, so here's a few more off Ridin Dirty, which could be the South's Moment of Truth

One Day

It's hard to hear Pimp C sing the hook and not tear up.

PInky Ring

Bun B's verse is so good they have to divide it up into two. For real? Is there a better Bun B verse?

Murder

Perhaps there is a better Bun B verse, and it's on this song. When he gets done, you yourself as the listener have to take a deep breath because you have processes so many words.

Wednesday, March 25, 2009

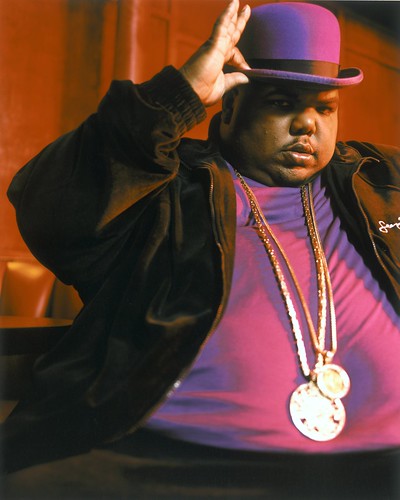

Big Moe

Big Moe was a great rapper from Houston Texas who died of a heart attack two years ago. He should not be confused with Houston's other legendary, large, and deceased rappers such as Fat Pat and Big Hawk. This song, Purple Stuff, actually might have done a big of damage on the charts, and it would have been interesting to see if Big Moe could have parlayed it into some type of long-awaited Texas Takeover of the rap game, but, we'll never know.

In the meantime, put this one in the category of not that Houston sounding Houston rap, it's kinda like Prince had a layover in Houston for two hours and had nothing else better to do than record something perfect.

Big Moe -- Purple Stuff

And while we're at it:

Big Hawk -- Chillin With My Broad

Fat Pat -- Tops Drop

I prefer the screwed and chopped version of Tops Drop, but I don't have it right now so it's too bad.

Thursday, March 19, 2009

Baltimore: Two Points

Today I went to a Attman's deli, which is on a street called "Corned Beef Row" for real. The very existence of such a street is a miracle of miracles, but the sandwich is was served was beyond. Tonight I'm going to a place where they dump crabs on your table like what. Baltimore just might be better than Pittsburgh.

I ate this one right here. How crazy is it to look a photo of something that no longer exists because I ate it? Also, they put a flag in it because I gave it an award.

Tuesday, March 17, 2009

Grunge

I found a whole slew of tracks of Neil Young and Crazy Horse rehearsing Ragged Glory in a big barn. When you put Neil Young in a barn and ask him to rehearse Ragged Glory, you get exactly what you think you would get. I'd say this would be the musical equivalent of the movie Defiance because everything you want in life is in it.

Love To Burn

Also, if you don't own Ragged Glory, it's a must.

Monday, March 16, 2009

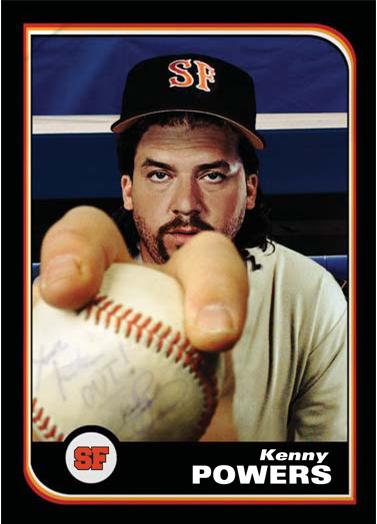

Eastbound and Down: Instant Classic

At this point, there's only one more episode left, and it's unclear if this will be the first and only season. What is very clear though is this show is brilliant. It's an instant classic. The only thing I can compare it to is Mr. Show with Bob And David. When it was on, at that point in my life, I couldn't believe I had the physical ability to actually laugh as hard as I did. Not a lot of my friends watched it, but over the years, you would meet people who were familiar with it, and their knowledge and appreciation of the show was a litmus-test for instant friendship. Meeting a friend's roommate's friend in a dorm room and sharing a passion for Mr. Show was as rock solid of a foundation one needed for building friendships. But then, slowly, Mr. Show became something everyone rightfully knew about. And when any bum on the street knows about it, the litmus test factor is gone. I'm not saying it's cool, or there was some type of diminishing coolness factor based on the show's popularity, if anything the opposite applies, only the morons and nerds would sit in a room and talk about how great Mr. Show was, all I'm saying is that once any serial killer or child molester can buy the dvds at Best Buy and watch it, you don't want to use the show as a pathway towards friendship.

But Eastbound and Down is that show. It's Mr. Show With Bob and David when Mr. Show was still for the dorks. It's The Wire before everyone caught on around the forth season, it's Freaks and Geeks. I don't know how many people currently watch it, but if it's anything less than the exact population of America the Great, then there's a problem. Eastbound and Down, watch it, love it, laugh.

Friday, March 13, 2009

Thursday, March 12, 2009

Wednesday, March 11, 2009

Charles W. Freeman Jr aka Chazzy Free Free gives it hard to the Israel Lobby

Freeman withdrew from his post as Chairman of the National Intelligence Council because he caught a big fat L from the Israel lobby who don't like him because you know, he believes that Palistianians have a few basic human rights of their own.

---------

I have concluded that the barrage of libelous distortions of my record would not cease upon my entry into office. The effort to smear me and to destroy my credibility would instead continue. I do not believe the National Intelligence Council could function effectively while its chair was under constant attack by unscrupulous people with a passionate attachment to the views of a political faction in a foreign country. I agreed to chair the NIC to strengthen it and protect it against politicization, not to introduce it to efforts by a special interest group to assert control over it through a protracted political campaign.

I am not so immodest as to believe that this controversy was about me rather than issues of public policy. These issues had little to do with the NIC and were not at the heart of what I hoped to contribute to the quality of analysis available to President Obama and his administration. Still, I am saddened by what the controversy and the manner in which the public vitriol of those who devoted themselves to sustaining it have revealed about the state of our civil society. It is apparent that we Americans cannot any longer conduct a serious public discussion or exercise independent judgment about matters of great importance to our country as well as to our allies and friends.

The libels on me and their easily traceable email trails show conclusively that there is a powerful lobby determined to prevent any view other than its own from being aired, still less to factor in American understanding of trends and events in the Middle East. The tactics of the Israel Lobby plumb the depths of dishonor and indecency and include character assassination, selective misquotation, the willful distortion of the record, the fabrication of falsehoods, and an utter disregard for the truth. The aim of this Lobby is control of the policy process through the exercise of a veto over the appointment of people who dispute the wisdom of its views, the substitution of political correctness for analysis, and the exclusion of any and all options for decision by Americans and our government other than those that it favors.

There is a special irony in having been accused of improper regard for the opinions of foreign governments and societies by a group so clearly intent on enforcing adherence to the policies of a foreign government – in this case, the government of Israel. I believe that the inability of the American public to discuss, or the government to consider, any option for US policies in the Middle East opposed by the ruling faction in Israeli politics has allowed that faction to adopt and sustain policies that ultimately threaten the existence of the state of Israel. It is not permitted for anyone in the United States to say so. This is not just a tragedy for Israelis and their neighbors in the Middle East; it is doing widening damage to the national security of the United States.

The outrageous agitation that followed the leak of my pending appointment will be seen by many to raise serious questions about whether the Obama administration will be able to make its own decisions about the Middle East and related issues. I regret that my willingness to serve the new administration has ended by casting doubt on its ability to consider, let alone decide what policies might best serve the interests of the United States rather than those of a Lobby intent on enforcing the will and interests of a foreign government.

For the record: I have never sought to be paid or accepted payment from any foreign government, including Saudi Arabia or China, for any service, nor have I ever spoken on behalf of a foreign government, its interests, or its policies. I have never lobbied any branch of our government for any cause, foreign or domestic. I am my own man, no one else’s, and with my return to private life, I will once again – to my pleasure – serve no master other than myself. I will continue to speak out as I choose on issues of concern to me and other Americans.

I retain my respect and confidence in President Obama and DNI Blair. Our country now faces terrible challenges abroad as well as at home. Like all patriotic Americans, I continue to pray that our president can successfully lead us in surmounting them.

---------

I have concluded that the barrage of libelous distortions of my record would not cease upon my entry into office. The effort to smear me and to destroy my credibility would instead continue. I do not believe the National Intelligence Council could function effectively while its chair was under constant attack by unscrupulous people with a passionate attachment to the views of a political faction in a foreign country. I agreed to chair the NIC to strengthen it and protect it against politicization, not to introduce it to efforts by a special interest group to assert control over it through a protracted political campaign.

I am not so immodest as to believe that this controversy was about me rather than issues of public policy. These issues had little to do with the NIC and were not at the heart of what I hoped to contribute to the quality of analysis available to President Obama and his administration. Still, I am saddened by what the controversy and the manner in which the public vitriol of those who devoted themselves to sustaining it have revealed about the state of our civil society. It is apparent that we Americans cannot any longer conduct a serious public discussion or exercise independent judgment about matters of great importance to our country as well as to our allies and friends.

The libels on me and their easily traceable email trails show conclusively that there is a powerful lobby determined to prevent any view other than its own from being aired, still less to factor in American understanding of trends and events in the Middle East. The tactics of the Israel Lobby plumb the depths of dishonor and indecency and include character assassination, selective misquotation, the willful distortion of the record, the fabrication of falsehoods, and an utter disregard for the truth. The aim of this Lobby is control of the policy process through the exercise of a veto over the appointment of people who dispute the wisdom of its views, the substitution of political correctness for analysis, and the exclusion of any and all options for decision by Americans and our government other than those that it favors.

There is a special irony in having been accused of improper regard for the opinions of foreign governments and societies by a group so clearly intent on enforcing adherence to the policies of a foreign government – in this case, the government of Israel. I believe that the inability of the American public to discuss, or the government to consider, any option for US policies in the Middle East opposed by the ruling faction in Israeli politics has allowed that faction to adopt and sustain policies that ultimately threaten the existence of the state of Israel. It is not permitted for anyone in the United States to say so. This is not just a tragedy for Israelis and their neighbors in the Middle East; it is doing widening damage to the national security of the United States.

The outrageous agitation that followed the leak of my pending appointment will be seen by many to raise serious questions about whether the Obama administration will be able to make its own decisions about the Middle East and related issues. I regret that my willingness to serve the new administration has ended by casting doubt on its ability to consider, let alone decide what policies might best serve the interests of the United States rather than those of a Lobby intent on enforcing the will and interests of a foreign government.

For the record: I have never sought to be paid or accepted payment from any foreign government, including Saudi Arabia or China, for any service, nor have I ever spoken on behalf of a foreign government, its interests, or its policies. I have never lobbied any branch of our government for any cause, foreign or domestic. I am my own man, no one else’s, and with my return to private life, I will once again – to my pleasure – serve no master other than myself. I will continue to speak out as I choose on issues of concern to me and other Americans.

I retain my respect and confidence in President Obama and DNI Blair. Our country now faces terrible challenges abroad as well as at home. Like all patriotic Americans, I continue to pray that our president can successfully lead us in surmounting them.

Tuesday, March 10, 2009

Newsweek

Letter To Madoff

Measuring the toll of the disgraced financier.

Rabbi Marc Gellman

Newsweek Web Exclusive

Dear Bernie Madoff:

I don't think you know what you have done.

Life inevitably inflicts upon us different kinds of wounds. Very few people can live connected lives and not occasionally fail those who depend upon them and trust them. However, these are failures not betrayals. They come from trying to do the right thing and not being able to do it. A betrayal is different than a failure. A betrayal is an intentional wounding. It is born of cruelty, not ignorance. Most of us know of failures and betrayals. What you have done, however, is to radically expand the scope and viciousness of betrayal. You betrayed not just your friends, but your closest friends. You betrayed the trust of those who entrusted you with everything they had saved. You betrayed charities whose good works you have extinguished in an afternoon. These betrayals are epic in their scope and dazzling in their utter lack of remorse or responsibility. There must be some new word invented to describe the way you have redefined betrayal. The Bible calls such things a toevah, "an abomination". It means an act so alien to our values and our natures that it cannot be understood or explained. You have committed an abomination. This is what you have done.

Another thing you did was make life incredibly more difficult for people who sell real and honorable and legitimate money products. Now every stock broker and money manager and hedge-fund operator and insurance rep who has already had a tough time convincing prospective clients that what they are selling is good and honest must now also convince them that they are not like you. An entire world economy we now know is based to an immense degree on simple trust, and you have done more than any single person to destroy that trust. You are a financial terrorist. Your attack has toppled the foundations of trust in our financial markets. Although you are not by any means the only financial terrorist, you are its most reviled attacker. What has brought us down are not worthless financial instruments, but worthless people. Many business people have always known and have never forgotten that trust is all the collateral they have ever placed against a loan. Your name is on people's lips now, but the ones out there selling honest products at a fair price ought to push your name into the gutter where it belongs. This is what you have done.

One of the very worst things you did has to do with the Jews. You are responsible for reviving the "Jew game." I heard of the Jew game from a boy who became a man last Saturday. I asked him once if he had ever experienced anti-Semitism in school. That is when he looked at the floor and told me about the Jew game. The game, played by anti-Semitic kids in school, was one in which they would hide around a corner, throw a quarter down the hall, and then when somebody picked up the quarter, they'd run at the person, shouting, "You're the Jew!"

You did not cause the anti-Semitic insults about Jews and money, but you caused them to be revived. Not since Julius Rosenberg spied for the Soviet Union has one person so damaged the image and the self-respect of American Jews. I am not comfortable with the fact that so many of the articles about you specifically identify your prominent place in the Jewish community. Ken Lay of Enron shame was never identified as a "prominent Protestant energy broker." The most aggressive accusers of the governor of Illinois seldom describe him as "the prominent Serbian-American governor of Illinois." Yes, it is unfair that your Jewishness has become part of the storyline. But you just reminded the bigots who grew up playing The Jew Game that it still strikes a familiar chord. You wiped out Joe Lieberman's accomplishments. You revived ancient bigotry against our people. You gave credence to the horrid accusations about Jews being untrustworthy and greedy. One offensive paper has a column called "Jews in the News," which focuses on some Jewish criminal or other to remind their sickening readers of the legitimacy of anti-Semitism. You are not just one of the "Jews in the news" they seek. You are the apotheosis of their hate-filled world. You have given the Jew-haters material for a decade of hate gardening. You single-handedly revived the Jew game. This is what you have done.

Most of those you've deceived will learn to live and give in new and perhaps more modest ways. Unlike your evil, which has been stopped, nothing will stop their courage and compassion. Some of your victims will no doubt be more severely wounded in circumstance and in spirit, but none of them, I pray, will surrender to your assault. Their friends will not leave them. Their children and grandchildren will not refuse to hug them and kiss them. After their initial trauma subsides, they will, I believe, move on to cling to the blessings that cannot ever be stolen.

You, on the other hand, will lose everything—everything! From this day to the end of your life, there will be none who will trust you. To be mistrusted by everyone is an enormous curse and you have brought this all upon yourself, and for what purpose? You were supposed to be the master of risk and reward and you risked everything from everyone for what reward? You have not just made a bad calculation about how money works, you have made a bad calculation about how life works. You gave no value to what matters and all value to what does not matter at all. This is what you have done.

Shame on you Bernie Madoff. Shame on you.

Measuring the toll of the disgraced financier.

Rabbi Marc Gellman

Newsweek Web Exclusive

Dear Bernie Madoff:

I don't think you know what you have done.

Life inevitably inflicts upon us different kinds of wounds. Very few people can live connected lives and not occasionally fail those who depend upon them and trust them. However, these are failures not betrayals. They come from trying to do the right thing and not being able to do it. A betrayal is different than a failure. A betrayal is an intentional wounding. It is born of cruelty, not ignorance. Most of us know of failures and betrayals. What you have done, however, is to radically expand the scope and viciousness of betrayal. You betrayed not just your friends, but your closest friends. You betrayed the trust of those who entrusted you with everything they had saved. You betrayed charities whose good works you have extinguished in an afternoon. These betrayals are epic in their scope and dazzling in their utter lack of remorse or responsibility. There must be some new word invented to describe the way you have redefined betrayal. The Bible calls such things a toevah, "an abomination". It means an act so alien to our values and our natures that it cannot be understood or explained. You have committed an abomination. This is what you have done.

Another thing you did was make life incredibly more difficult for people who sell real and honorable and legitimate money products. Now every stock broker and money manager and hedge-fund operator and insurance rep who has already had a tough time convincing prospective clients that what they are selling is good and honest must now also convince them that they are not like you. An entire world economy we now know is based to an immense degree on simple trust, and you have done more than any single person to destroy that trust. You are a financial terrorist. Your attack has toppled the foundations of trust in our financial markets. Although you are not by any means the only financial terrorist, you are its most reviled attacker. What has brought us down are not worthless financial instruments, but worthless people. Many business people have always known and have never forgotten that trust is all the collateral they have ever placed against a loan. Your name is on people's lips now, but the ones out there selling honest products at a fair price ought to push your name into the gutter where it belongs. This is what you have done.

One of the very worst things you did has to do with the Jews. You are responsible for reviving the "Jew game." I heard of the Jew game from a boy who became a man last Saturday. I asked him once if he had ever experienced anti-Semitism in school. That is when he looked at the floor and told me about the Jew game. The game, played by anti-Semitic kids in school, was one in which they would hide around a corner, throw a quarter down the hall, and then when somebody picked up the quarter, they'd run at the person, shouting, "You're the Jew!"

You did not cause the anti-Semitic insults about Jews and money, but you caused them to be revived. Not since Julius Rosenberg spied for the Soviet Union has one person so damaged the image and the self-respect of American Jews. I am not comfortable with the fact that so many of the articles about you specifically identify your prominent place in the Jewish community. Ken Lay of Enron shame was never identified as a "prominent Protestant energy broker." The most aggressive accusers of the governor of Illinois seldom describe him as "the prominent Serbian-American governor of Illinois." Yes, it is unfair that your Jewishness has become part of the storyline. But you just reminded the bigots who grew up playing The Jew Game that it still strikes a familiar chord. You wiped out Joe Lieberman's accomplishments. You revived ancient bigotry against our people. You gave credence to the horrid accusations about Jews being untrustworthy and greedy. One offensive paper has a column called "Jews in the News," which focuses on some Jewish criminal or other to remind their sickening readers of the legitimacy of anti-Semitism. You are not just one of the "Jews in the news" they seek. You are the apotheosis of their hate-filled world. You have given the Jew-haters material for a decade of hate gardening. You single-handedly revived the Jew game. This is what you have done.

Most of those you've deceived will learn to live and give in new and perhaps more modest ways. Unlike your evil, which has been stopped, nothing will stop their courage and compassion. Some of your victims will no doubt be more severely wounded in circumstance and in spirit, but none of them, I pray, will surrender to your assault. Their friends will not leave them. Their children and grandchildren will not refuse to hug them and kiss them. After their initial trauma subsides, they will, I believe, move on to cling to the blessings that cannot ever be stolen.

You, on the other hand, will lose everything—everything! From this day to the end of your life, there will be none who will trust you. To be mistrusted by everyone is an enormous curse and you have brought this all upon yourself, and for what purpose? You were supposed to be the master of risk and reward and you risked everything from everyone for what reward? You have not just made a bad calculation about how money works, you have made a bad calculation about how life works. You gave no value to what matters and all value to what does not matter at all. This is what you have done.

Shame on you Bernie Madoff. Shame on you.

Monday, March 9, 2009

A City Foreclosed

What happens to a city when people loose their homes in staggering numbers? Alex Kotlowitz, who we all remember from There Are No Children Here, takes us on a mind-numbing tour of Cleveland's Slavic Village where block after block of vacant homes give way to urban apocalypse.. It's not an uplifting story. Cleveland has to ward off predatory lending, evil real-estate speculators, squatters setting houses on fire, a decline in a tax-base that would blow your mind, and so much more. And here's the thing, there's not too much they can do except razing the homes, and even that, even home demolitions are damn near prohibitively expensive.

Read it.

For more brilliance on Kotlowitz, read his love letter to Chicago. A truly great book and probably my second favorite book ever written about the city after the historical triumph of American Pharaoh. For more on Cleveland, go here.

Blackout 2: WHAT IT DO!

Yesterday, Meth and Red dropped a joint that's supposedly off their upcoming Blackout 2. I never even knew Blackout 2 had moved from the realm of hip-hop wet dream to actually has been recorded and waiting to be released. A scour of the internet has shown a possible release dates, but none of them make any sense.

Another Blackout! For real, this is amazing. Another Blackout!

About a year ago, Meth and Red teamed up to do a remake of Smoothe Da Hustla's "Broken Language," and if that joint is inditicative of anything off Blackout 2, no one will be dissapointed. Meth and Red - Broken Language 08

Here's a few things I remember about Blackout:

1. It seemed to be on all the time whenever we would play Mario Kart against each other.

2. Every song on it was truly amazing.

3. It's one of those rare hip-hop albums that appeals to all types of rap fans.

4. There were so many crazy verses and amazing lines to point out to your friends. And that's what it's all about, pointing out the jaw-dropping verses to your friends.

5. It had the dubious distinction of being the best album that came out within six months of the greatest album of all time.

6. It got a lot of people I knew who were not into hip-hop to really appreciate the music.

7. It doesn't sound old. Even though it's an album that holds a shit load of nostalgia, it could have been made yesterday.

When we get closer to the release date, expect many more memories.

Also, if you haven't ever heard the original Broken Langauage, sheeeeeeeeeet. You need to right now. There's no better version of east-coast, utter stream of conscineness, hard-core braggadocio.

I've posted the video, so you don't even need to waste time downloading it, but I also reccomend you go here, and read the lyrics, and follow along whilst you watch.

Friday, March 6, 2009

What's become of Friendster these days

Ye Olde Social Network

Friendster is at once a thriving success and a robot-ruled ghost planet.

"Former users returning after a long absence will find friends' profiles resting in a circa-2006 state. My old roommate, who has earned a master's degree, worked at a newspaper in Minneapolis, gotten married, and moved to the South Pacific with his wife since he ceased to be my roommate, is still sleeping right next-door, per Friendster."

Thursday, March 5, 2009

C-Murder

Here's why you should never change your name to C-Murder:

Because what if one day, you are actually accused and tried for murder, it would make proving your case so much more difficult. At least, I thought. Turns out, C-Murder, aka Corey Miller, is a lucky guy and not a victim of namism. (the worst form of prejudice.)

In 2003, he was convicted of shooting a 16-year old fan, Steve Thomas, at a concert. A Judge later ruled the prosecutors failed to turn over valuable evidence that would have helped his defense, and C Murder was granted a new trial. Since then, he's basically been on house arrest. Meanwhile, the judge who granted him a new trial was voted out of office, he's been allowed to promote every album he's released, an associate of C-Murder has recently been arrested for trying to intimate a witness in the Thomas trial, and the list goes on. I used to think one of the great blessings of my life was being lucky enough to not be tried for murder after having changed my name to C Murder. But I guess it doesn't matter.

Yesterday a judge ruled once more in C-Murder's favor. Apparently whatever the prosecutors claim he's been doing that's been violating the terms of his house arrest, in fact, does not violate the terms of his house arrest. And so, he doesn't have to go back to jail. In honor of this ongoing saga, I'd like to introduce a new, semi-regular feature to the blog:

Rappers That Have Actually Killed People.

Rappers That Have Actually Killed People #1: E Moneybags

IN 1999, E Moneybags released his first and only album, In Moneybags We Trust. it features some pretty high level collaborations with the likes of Nas, Noreaga, and a few others. Overall, it's not that bad of an album. It won't win any prizes, but it's a good template for that old Queensbridge sound at the turn of the century.

Thing was, E Moneybags had served time, and for a double-homicide at that. And although it was never proven who in his crew was the shooter, he'd been bragging all over New York once he got out he had pulled the trigger. Problem was the guy he killed, Colbert Johnson, a a good friend of Kenneth "Supreme" McGriff. Who as further blog entries will be devoted to, but all you gotta know now is that he was the head of one of the fiercest crack crews New York had ever known.

Supreme wanted retaliation, and on July 16, 2001, a group of thugs rolled up on Moneybags and shot him ten times. A few years later, the feds raided a McGriff stash house in Baltimore and discovered a videotape showing extensive surveillance of E Moneybags. The video followed his car right up to minutes before he got shot.

thugs calm down

Next on rappers that have actually killed people: Gucci Mane.

Wednesday, March 4, 2009

PHONE IN TOILET

I dropped my phone in the toilet today. In honor of this event, I'd like to share the following exchange in which a dear friend relates his own experience with this terrible nightmare:

spencer: HEY

me: yo

spencer: ignorer

me: just dropped my phone int he toliet

spencer: ha! really shitty?

spencer: shirtty?!

me: pissy

spencer: aw man

me: dude

spencer: thought you were gonna join my club

me: and it was top five longest pisses ever

dude shit would be fine no wetness to permeatue

permeate

spencer: what the fuck are you talkin

i mean besides the fact that you shit into a bowl of water

2:53 PM

thats usually also full of piss

aside from those things

me: yeah

spencer: which mean wetness is a factor

me: byt theres a chance the phone might rest atop a shit

if it's a solid shit

spencer: dropping iyour phone into a pile of your own shit, sucks

me: im not saying it doesnt

spencer: true but thats one in a million

2:54 PM

me: but at least you have a chance

spencer: when it happened to me

I was in a public bathroom

someone had already KNOCKED

2:55 PM

because I had been in there reading thenews for a while

dropped phone

instinct to plunge hand in after phone takes effect immdiately

whole hand in shit cant get it!

wedged in.... shaft? hole?

2:56 PM

two hands, IN shit everywhere cant get it

take out my knife

knidfe, hand, and other hand, IN

(banging on door) (laughing, sweating)

use knife to pry out phone

2:57 PM

screen is on whole time by the way

wash up and leave, phone works for a little while then kicks the buket

never stops smelling like shit

3:05 PM

me: WOW amazing

Please feel free to send in your own phone in liquid stories. And remember to stay clear of Spencer's hands.

Free Throws

Good article on free throws. Over 50 years, the free throw percentage has remained the same.

In the mid 60's men's college payers made 69 percent of free throws, this season, the percentage is 68.8 percent.

In the NBA, the average is 75 percent and has stayed there for 50 years.

"The general expectation in sports is that performance improves over time. Future athletes will surely be faster, throw farther, jump higher. But free-throw shooting represents a stubbornly peculiar athletic endeavor. As a group, players have not gotten better. Nor have they become worse.

“It’s unbelievable,” Larry Wright, an adjunct professor of statistics at Columbia, said as he studied the year-by-year averages. “There’s almost no difference. Fifty years. This is mind-boggling.”"

Rest of the article here.

In the mid 60's men's college payers made 69 percent of free throws, this season, the percentage is 68.8 percent.

In the NBA, the average is 75 percent and has stayed there for 50 years.

"The general expectation in sports is that performance improves over time. Future athletes will surely be faster, throw farther, jump higher. But free-throw shooting represents a stubbornly peculiar athletic endeavor. As a group, players have not gotten better. Nor have they become worse.

“It’s unbelievable,” Larry Wright, an adjunct professor of statistics at Columbia, said as he studied the year-by-year averages. “There’s almost no difference. Fifty years. This is mind-boggling.”"

Rest of the article here.

Monday, March 2, 2009

A.I.G.

With A.I.G. reporting a ONE QUARTER LOSS OF 61.7 BILLION DOLLARS, Joe Nocera wrote a great piece in the New York Times explaining how this happened, why they need to be kept afloat, and why we should all be disgusted.

Here are some highlights:

"As a huge multinational insurance company, with a storied history and a reputation for being extremely well run, A.I.G. had one of the most precious prizes in all of business: an AAA rating,...That meant ratings agencies believed its chance of defaulting was just about zero..A.I.G. was saying if, by some remote chance (ha!) those mortgage-backed securities suffered losses, the company would be on the hook for the losses. And because A.I.G. had that AAA rating, when it sprinkled its holy water over those mortgage-backed securities, suddenly they had AAA rating

"A.I.G. operated on the belief that the underlying assets — housing — could only go up in price. That foolhardy belief, in turn, led A.I.G. to commit several other stupid mistakes. When a company insures against, say, floods or earthquakes, it has to put money in reserve in case a flood happens...And it didn’t. Its leverage was more akin to an investment bank than an insurance company. So when housing prices started falling, and losses started piling up, it had no way to pay them off. Not understanding the real risk, the company grievously mispriced it."

"It agreed to something called “collateral triggers,” meaning that if certain events took place, like a ratings downgrade for either A.I.G. or the securities it was insuring, it would have to put up collateral against those securities. Again, the reasons it agreed to the collateral triggers was pure greed: it could get higher fees by including them. And again, it assumed that the triggers would never actually kick...Those collateral triggers have since cost A.I.G. many, many billions of dollars. Or, rather, they’ve cost American taxpayers billions.

"Under a misguided set of international rules that took hold toward the end of the 1990s, banks were allowed use their own internal risk measurements to set their capital requirements...How did banks get their risk measures low? It certainly wasn’t by owning less risky assets. Instead, they simply bought A.I.G.’s credit-default swaps. The swaps meant that the risk of loss was transferred to A.I.G., and the collateral triggers made the bank portfolios look absolutely risk-free. Which meant minimal capital requirements...That lack of capital is one of the reasons the European banks have been in such trouble since the crisis began."

"There’s more, believe it or not. A.I.G. sold something called 2a-7 puts, which allowed money market funds to invest in risky bonds even though they are supposed to be holding only the safest commercial paper. How could they do this? A.I.G. agreed to buy back the bonds if they went bad. (Incredibly, the Securities and Exchange Commission went along with this.) A.I.G. had a securities lending program, in which it would lend securities to investors, like short-sellers, in return for cash collateral. What did it do with the money it received? Incredibly, it bought mortgage-backed securities. When the firms wanted their collateral back, it had sunk in value, thanks to A.I.G.’s foolish investment strategy. The practice has cost A.I.G. — oops, I mean American taxpayers — billions.

"Here we are now, fully aware of how these scams worked. Yet for all practical purposes, the government has to keep them going. Indeed, that may be the single most important reason it can’t let A.I.G. fail. If the company defaulted, hundreds of billions of dollars’ worth of credit-default swaps would “blow up,” and all those European banks whose toxic assets are supposedly insured by A.I.G. would suddenly be sitting on immense losses....and now the government has to actually back up those contracts with taxpayer money to keep the banks from collapsing. It would be funny if it weren’t so awful.

"More than even Citi or Merrill, A.I.G. is ground zero for the practices that led the financial system to ruin.

“They were the worst of them all,” said Frank Partnoy, a law professor at the University of San Diego and a derivatives expert. Mr. Vickrey of Gradient Analytics said, “It was extreme hubris, fueled by greed.” Other firms used many of the same shady techniques as A.I.G., but none did them on such a broad scale and with such utter recklessness. And yet — and this is the part that should make your blood boil — the company is being kept alive precisely because it behaved so badly."

"If we let A.I.G. fail, said Seamus P. McMahon, a banking expert at Booz & Company, other institutions, including pension funds and American and European banks “will face their own capital and liquidity crisis, and we could have a domino effect.” A bailout of A.I.G. is really a bailout of its trading partners — which essentially constitutes the entire Western banking system."

Here are some highlights:

"As a huge multinational insurance company, with a storied history and a reputation for being extremely well run, A.I.G. had one of the most precious prizes in all of business: an AAA rating,...That meant ratings agencies believed its chance of defaulting was just about zero..A.I.G. was saying if, by some remote chance (ha!) those mortgage-backed securities suffered losses, the company would be on the hook for the losses. And because A.I.G. had that AAA rating, when it sprinkled its holy water over those mortgage-backed securities, suddenly they had AAA rating

"A.I.G. operated on the belief that the underlying assets — housing — could only go up in price. That foolhardy belief, in turn, led A.I.G. to commit several other stupid mistakes. When a company insures against, say, floods or earthquakes, it has to put money in reserve in case a flood happens...And it didn’t. Its leverage was more akin to an investment bank than an insurance company. So when housing prices started falling, and losses started piling up, it had no way to pay them off. Not understanding the real risk, the company grievously mispriced it."

"It agreed to something called “collateral triggers,” meaning that if certain events took place, like a ratings downgrade for either A.I.G. or the securities it was insuring, it would have to put up collateral against those securities. Again, the reasons it agreed to the collateral triggers was pure greed: it could get higher fees by including them. And again, it assumed that the triggers would never actually kick...Those collateral triggers have since cost A.I.G. many, many billions of dollars. Or, rather, they’ve cost American taxpayers billions.

"Under a misguided set of international rules that took hold toward the end of the 1990s, banks were allowed use their own internal risk measurements to set their capital requirements...How did banks get their risk measures low? It certainly wasn’t by owning less risky assets. Instead, they simply bought A.I.G.’s credit-default swaps. The swaps meant that the risk of loss was transferred to A.I.G., and the collateral triggers made the bank portfolios look absolutely risk-free. Which meant minimal capital requirements...That lack of capital is one of the reasons the European banks have been in such trouble since the crisis began."

"There’s more, believe it or not. A.I.G. sold something called 2a-7 puts, which allowed money market funds to invest in risky bonds even though they are supposed to be holding only the safest commercial paper. How could they do this? A.I.G. agreed to buy back the bonds if they went bad. (Incredibly, the Securities and Exchange Commission went along with this.) A.I.G. had a securities lending program, in which it would lend securities to investors, like short-sellers, in return for cash collateral. What did it do with the money it received? Incredibly, it bought mortgage-backed securities. When the firms wanted their collateral back, it had sunk in value, thanks to A.I.G.’s foolish investment strategy. The practice has cost A.I.G. — oops, I mean American taxpayers — billions.

"Here we are now, fully aware of how these scams worked. Yet for all practical purposes, the government has to keep them going. Indeed, that may be the single most important reason it can’t let A.I.G. fail. If the company defaulted, hundreds of billions of dollars’ worth of credit-default swaps would “blow up,” and all those European banks whose toxic assets are supposedly insured by A.I.G. would suddenly be sitting on immense losses....and now the government has to actually back up those contracts with taxpayer money to keep the banks from collapsing. It would be funny if it weren’t so awful.

"More than even Citi or Merrill, A.I.G. is ground zero for the practices that led the financial system to ruin.

“They were the worst of them all,” said Frank Partnoy, a law professor at the University of San Diego and a derivatives expert. Mr. Vickrey of Gradient Analytics said, “It was extreme hubris, fueled by greed.” Other firms used many of the same shady techniques as A.I.G., but none did them on such a broad scale and with such utter recklessness. And yet — and this is the part that should make your blood boil — the company is being kept alive precisely because it behaved so badly."

"If we let A.I.G. fail, said Seamus P. McMahon, a banking expert at Booz & Company, other institutions, including pension funds and American and European banks “will face their own capital and liquidity crisis, and we could have a domino effect.” A bailout of A.I.G. is really a bailout of its trading partners — which essentially constitutes the entire Western banking system."

Andy Rooney, what a looney.

For those who have never had the pleasure or occasion to see an Andy Rooney "editorial" I couldn't think of a better introduction. This one has it all. Rambling on end? Check. Change of topic and confusion over his own subject matter? Check. Outdated stock footage that does little to prove his own point? Check. Intense close up of Rooney's insanely large eyebrows? Check. The list goes on.

In this one, Andy takes valuable network time to discuss the different months of the year, and how they are spelled, and how he thinks we should spell them.

Watch CBS Videos Online

In this one, Andy takes valuable network time to discuss the different months of the year, and how they are spelled, and how he thinks we should spell them.

Watch CBS Videos Online